Smoking and Election Day

by Jay Bitkower on December 26, 2016Election Day was also a day in which four states have referendums on raising their taxes on cigarettes: Colorado, California, Missouri, and North Dakota. Below, we’ll look at the tax proposals, arguments for and against, campaign spending and the groups behind them, and the results of the voting. Much of the voting information is extracted from the Ballotpedia website.

According to the Centers for Disease Control, over 480,000 Americans die from diseases caused by cigarette smoking, one in every five deaths. It is also a major risk factor for several cancers and the number one risk factor for kidney cancer, and is believed to cause close to 30% of kidney cancers.

Most studies have shown that raising taxes on cigarettes is a very effective way of reducing smoking among youth, young adults, and low-income people. Given that 90% of adults start smoking before age 20, this can be a very effective policy in reducing participation and the level of consumption of cigarettes. There is also some evidence that higher prices through tax increases can reduce initiation of smoking. In addition, raising taxes on cigarettes can raise revenue to pay for society’s health care costs that are due to use of tobacco products and smoking cessation programs. So, it seems reasonable that increasing taxes on cigarettes is beneficial to societal health and is thus a good thing to do. As we’ll see, some people think otherwise.

Keep in mind that the current average state tobacco tax is $1.65 per pack. In addition, the federal government levies a tax of $1.01 for a pack of cigarettes.

Colorado

The ballot initiative in Colorado, Amendment 72, called for an increase in the tax on a pack of cigarettes of $1.75 over the current tax of 84 cents a pack, bringing the total tax to $2.59, a 108% increase. Over 90% of the new revenue would go to health and tobacco related programs. Supporters of the referendum used the standard argument that an increase in the tax would help deter tobacco use, which causes cancer, heart disease, and lung problems. The additional revenue would help offset the costs of tobacco use to the states health care costs, estimated at $1.9 billion a year.

The detractors use an interesting argument. They say that poor people smoke more than other income groups, and, given that smoking is addictive, many won’t be able to quit so they will suffer the additional burden of having their disposable income reduced by an increased tax. That logic is similar to saying that automobile companies shouldn’t be required to install seatbelts given the additional burdensome costs to the price of cars to lower income people.

As of the end of October, the supporters of Amendment 72 raised $2,383,964 in campaign contributions to promote the amendment. Those in opposition raised $17,447,554 to fight the referendum, over seven times as much! The largest contributors to the pro-tax side were the American Heart Association, a University of Colorado health association, a physicians association, and a children’s hospital. The opposed spender is the No Blank Checks in the Constitution committee, whose largest contributor, Altria, raised $17,412,654, or 99.8% of the total. Not surprisingly, the Altria is the parent company of Philip Morris.

Referendum results: Amendment 72 defeated 54% to 46%. “By defeating Amendment 72 we have taken a step backwards in improving our health, and more tragically, we have let our kids down,” said Dr. David C. Goff Jr., dean of the Colorado School of Public Health and board president of the Denver chapter of the American Heart Association – as reported by the Denver Post.

California

In California, Proposition 56 called for an increase over the current 87 cents a pack tax to $2.87, a 130% increase.

Over 90% of the new revenue would go to health and tobacco related programs. Supporters of the referendum used the standard argument that an increase in the tax would help deter tobacco use, which causes cancer, heart disease, and lung problems. The additional revenue would help offset the costs of tobacco use to the states health care costs, estimated at $1.9 billion a year. Revenue from the tax would first go to making up the shortfall from the current tax due to the reduction in tobacco consumption, then towards administration of the tax. Thereafter, the first $118 million would go to health care items and tobacco laws enforcement. Finally, the bulk of what’s left would go to Medi-Cal, California’s health program for low-income families.

Supporters said that the new tax would reduce tobacco-related healthcare costs and would help pay for those costs, and would reduce youth smoking rates as well as prevent youth from starting to smoke. They say that California taxpayers spend $33.5 billion each year on tobacco-related diseases. An LA Times editorial in favor of the Proposition claimed that “on average, peer-reviewed studies have shown, a 10% increase in the total price of cigarettes will yield a 3% to 4% reduction in adult consumption — and a 7% reduction among young smokers”. Opponents claim that this is just another “tax hike grab” that would benefit insurance companies and wealthy special interests like physicians who treat Medi-Cal patients. But, again according to the LA Times, “the Medi-Cal reimbursement rates are currently 49th in the nation — so low that they discourage doctors and hospitals from accepting the low-income patients who are served by it”.

Supporters of Proposition 56 raised $35 million to promote the referendum while opponents raised $71 million, a 2:1 advantage. The major contributor in support is “Yes on 56”, a coalition of doctors, health plans, hospitals, and health advocate organizations. The major contributor to that, at $11.3 million, is Tom Steyer, a hedge fund manager, who contributes to several causes such as global warming issues and to Democratic candidates. The two major opponents were Philip Morris at $38.6 million and R.J. Reynolds at $24.9 million.

Referendum results: Proposition 56 was approved, 64% to 36%. According to non-partisan estimates the tax could raise $1.3 billion a year, most of which would go to the state’s Medi-Cal health care program for low-income residents.

North Dakota

North Dakota’s Initiated Statutory Measure 4 called for and increase in taxes from 44 cents a pack, the fourth lowest in the nation, to $2.20 a pack as well as doubling the tax on the wholesale price on other tobacco products from 28 percent to 56 percent. North Dakota must get a lot of traffic from their neighboring states, Montana, South Dakota, and Minnesota, whose cigarette taxes are $1.70, $1.53, and $3.00. The revenue would fund veterans programs.

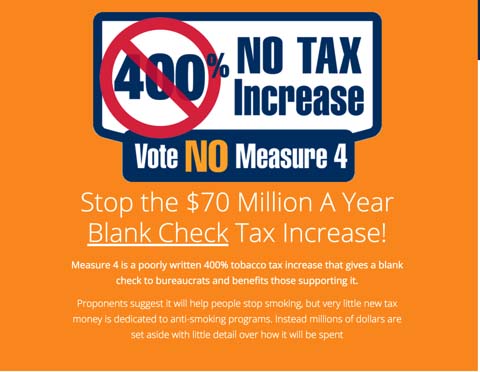

The arguments for the initiative were to prevent and reduce tobacco use, reduce health care costs from reductions in adult and youth tobacco use, and provide funding for veterans’ health care. The proponent of the excise tax was Raise it for Health North Dakota, which is a coalition of several health advocate and veterans organizations. The opponent was North Dakotans against the 400% Tax Increase, a coalition of groups that objects to the initiative since it is not specific enough on which veterans’ programs would be funded, not enough of the money would be spent on anti-smoking programs, and tax money should be spent on more important issues like building roads, schools, and fighting crime.

Raise it for Health ND raised $21,961.26 to support the initiative. On the other hand, the North Dakotans Against the 400% Tax Increase raised $3,631,935.78, which amounts to $165 in opposition for every $1 in support! The two principal donors were Altria at $2.5 million and R.J. Reynolds at $943,709.

Referendum results: Initiated Statutory Measure 4 was defeated 62% to 38%.

Note that in October, supporters of the initiative filed a complaint that the opponents violated ND Election Law by putting out misleading information, specifically that, in their campaign materials, they railed against a 400% tax increase but did not say it was on tobacco taxes. We found the following ad on-line. It does mention “tobacco” but in the fine print.

Conclusion

At this point, everyone, including the cigarette company executives, know that cigarette smoking is bad for your health, causing heart disease, cancer, and other maladies. We also know that higher costs for tobacco, i.e., increases in tobacco taxes, dissuades people from smoking. The CDC estimates that 90% of cigarette smokers started by the age of 18., and “If smoking continues at the current rate among youth in this country, 5.6 million of today’s Americans younger than 18 will die early from a smoking-related illness”. But, it’s never too late to stop. In a recent 7-year study, with 160,000 participants, published by the American Journal of Preventive Medicine, it was found that people who stopped smoking in their 60s had a 23% lower risk of death during the study than participants who continued to smoke during the study period – Cigarette Smoking and Mortality.

Smoking and the use of other tobacco products are threats to public health, and everything possible should be done to reduce and eventually stop the practice, including raising taxes on cigarettes.